The Basics:

On November 4, voters of the City of Bellbrook will be asked to vote on an ISSUE that would allocate 2.2 mills of funding for the specific purpose of Public Safety Services. That means the funds can only be used for Police, Fire, and EMS. It will generate $610,000 for the City to cover the current shortfall of funds purposed for:

- Critical Police Operations Subsidy of $420,000

- Critical Fire/EMS Operations Subsidy of $190,000

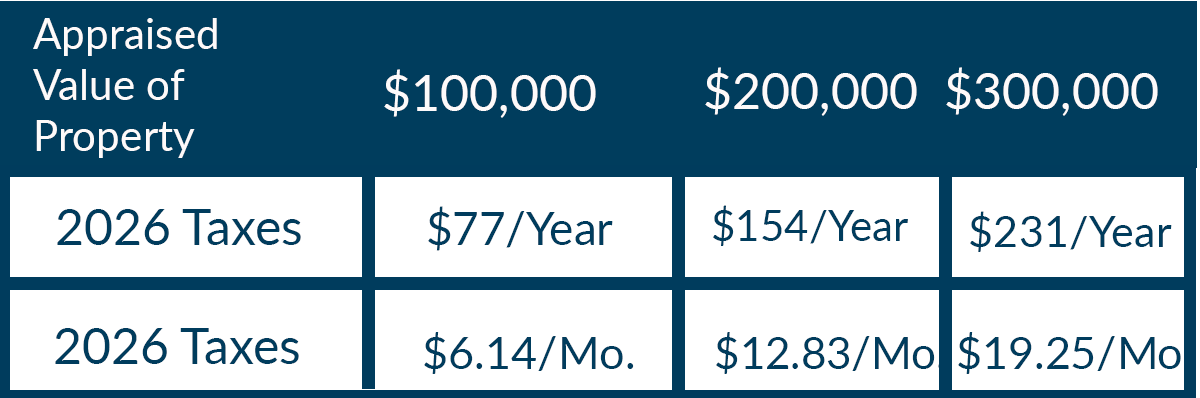

The 2.2 mill levy would cost $77 per $100,000 of appraised value.

Click the chart above for Greene County Auditor data

Click HERE to view the County Auditor Certification

12.5% Rollback Credit is provided to homeowners for existing millage and will not be affected with placement of the additional 2.2 mills.

What is a "Mill"? One mill is one-thousandth of a dollar, or one-tenth of a cent - $0.001 A mill is equal to $1 of tax for every $1,000 of Assessed Value. The assessed value is 35% of the Appraised value.

For details on Real Estate Taxes in Ohio, CLICK HERE to view former Greene County Auditor David Graham's description.